The most common goal we see with doctors in training is how to approach buying a house, whether that be your first house or your next one.

First, there are a few basics to revisit... for examples, what is a home loan?

Imagine this, you’re driving home from the hospital and you see this house up for sale.

How do you go about paying for this property?

Unless you are fortunate enough to have $700,000 sitting around in a bank account, it is likely you will need to get a home loan.

How does a loan work?

In a nutshell, the bank gives you the money you ask for and asks you to pay it back over a number of years. They also charge you interest on the outstanding balance, to pay for the privilege of using their money. When a bank (or anyone) gives you a loan, they are taking on some form of risk that they might not get their investment back. With investments, there is usually a risk / return trade off. A higher risk can often lead to a higher return.

So, to cover themselves and reduce their risk, the bank will take out a mortgage over the property. This means that if you stop paying your loan, or in various other circumstances, they have the right to take possession of the property and ensure they can recover their investment.

And that is why you see interest rates on home loans – as low as 2% at present – compared with say a credit card of 18%. The home loan is seen by the bank as a safer investment than a credit card.

But – it’s not all about the interest rate! We want flexibility for the long term too.

The banks also look at how much equity you have in the house. For your first house this means how much deposit you have saved up. The more equity you have, the less risky it is for the bank. In Australia, if you borrow more than 80% of the value of the house, you will likely be charged a lenders mortgage insurance premium by the bank. This covers them, not you and it can add up to big dollars.

Now, as a doctor in training or dentist, the banks are often happier to accept more risk when lending to you than they are to other professions. This means that you can get into a house with 5-10% deposit but not pay any mortgage insurance. On a $700,000 house this means you could get into the house with up to $100,000 less without paying that premium.

We’ve been helping medical and dental professionals for over 65 years, and history tells us that your next house likely won’t be your last! So, we encourage our clients to think of the bigger picture, and that means structuring your loans for flexibility for the future.

This means, making use of an offset account and understanding tax efficient debt. That is debt where you can deduct the cost of the loan (interest) against the income you earn from that which is rent income from your tenants.

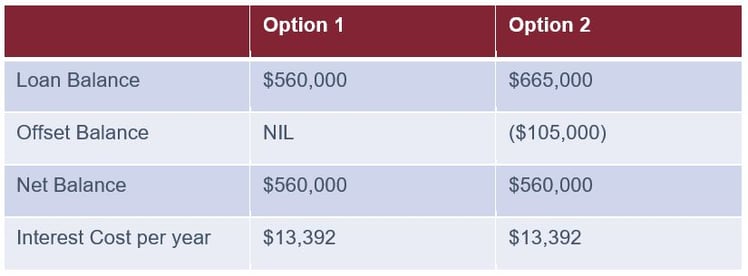

An offset account is a bank account that is linked to your loan account. Interest is charged on the combined balance.

In this example of a purchase price around $700,000. If you have been able to save up for a 20% deposit which is $560,000. If you just got the lowest loan possible, you would be charged interest on the balance of $560,000, which these days is around $13,000.

However if you instead used only 5% up front and put the remainder in your offset account, you are still only charged interest on the combined $560,000 balance, so the interest cost is the same at around $13,000 per year.

This is a great way to springboard into your next property and make the most of the growth in value over time, whilst being able to maximise the deductible debt and reduce the non-deductible debt.

Don't forget about the first home buyer benefits available in your state, which can include the stamp duty concessions, and making use of the First Home Super Saver Scheme.

Remember too, that with finance and banking, there is no ‘set and forget’ strategy – it is important to keep checking your structure, be it one loan or many, to make sure it fits your current stage in life.

Get in touch with us today to talk through this some more.